NEED HELP?

Clients like Families (Trusts), or Individuals, or Small Businesses, Companies, or Sovereign Countries or Other Shapes of all sizes SERIOUS ABOUT DIGITAL GOLD can create Strategic Bitcoin Reserves by adopting several strategic steps and considering various factors:

Understand the Purpose:

Hedging Against Inflation: Bitcoin's fixed supply makes it an attractive option as a hedge against inflation, protecting the company's purchasing power over time.

Diversification: Adding Bitcoin to the treasury can diversify asset holdings, potentially reducing risk associated with traditional financial instruments.

Policy and Strategy Development:

Establish a clear policy on how much of the treasury should be allocated to Bitcoin, similar to how companies might allocate to gold or other assets. This could involve setting a percentage of liquid assets or a fixed dollar amount.

Consider the volatility of Bitcoin and develop a strategy for when to buy or sell, perhaps employing dollar-cost averaging to mitigate price swings.

Regulatory Compliance:

Ensure compliance with local and international regulations regarding cryptocurrency holdings. This includes understanding tax implications, reporting requirements, and potential legal changes that might affect such holdings.

Security Measures:

Invest in secure storage solutions for Bitcoin, which could range from hardware wallets for smaller companies to more complex, cold storage solutions for larger ones. Security is paramount due to the risk of digital theft.

Integration into Financial Planning:

Integrate Bitcoin into the company's broader financial strategy. This might involve using Bitcoin for transactions if applicable or holding it strictly as a reserve asset. Companies like MicroStrategy have shown how Bitcoin can become a significant part of a company's treasury strategy.

Employee Education and Buy-In:

Educate key decision-makers and employees about the benefits and risks of Bitcoin to ensure there's an understanding and acceptance of this new asset class within the company culture.

Financial Management and Reporting:

Develop methods for accounting for Bitcoin on financial statements, understanding its volatile nature could impact financial reporting. This includes setting up systems to track market value changes for accurate reporting.

Long-term Vision:

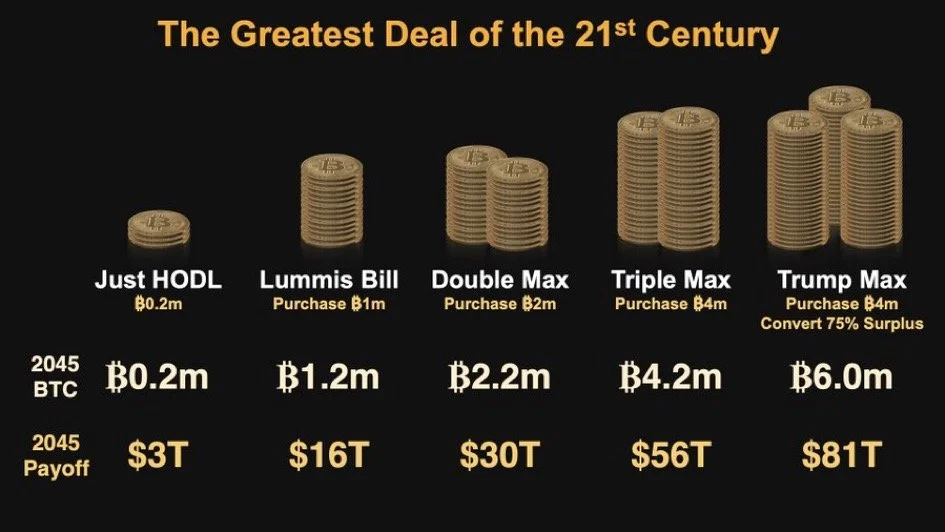

Consider Bitcoin not just as a speculative investment but as a long-term strategic asset. This might mean holding Bitcoin for extended periods, similar to what's proposed with government strategic reserves, which might not be liquidated for decades.

Risk Management:

Understand the geopolitical and market risks associated with Bitcoin. Companies must prepare for scenarios where Bitcoin's value could fluctuate dramatically, affecting balance sheets and investor confidence.

Public and Investor Relations:

Communicate the strategy effectively to stakeholders, ensuring they understand why and how Bitcoin is being used as a reserve. This transparency can help manage expectations and perceptions about the company's financial health and strategy.

By following these strategies, companies can responsibly incorporate Bitcoin into their financial reserves, aiming to leverage its potential benefits while managing its inherent risks.